Tax withholding estimator 2022

Currently there is no. You can use the Tax Withholding Estimator to estimate your 2020 income tax.

Calculation Of Federal Employment Taxes Payroll Services

Fields notated with are required.

. The student will be required to return all course materials. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022. 15 Tax Calculators 15 Tax Calculators.

If your income and tax situation are similar to last year enter your tax for the prior year. 2021 Withholding Tax Forms If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021 visit Michigan Treasury Online MTO to file or access the 2021 Sales Use and Withholding Taxes Annual Return fillable form. CTEC 1040-QE-2662 2022 HRB Tax Group Inc.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Available in TurboTax Self-Employed and TurboTax Live Self-Employed. Enter your projected tax for 2022.

Fillable Forms Disclaimer Many tax forms can now be completed on-line for printing and mailing. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. For help with your withholding you may use the Tax Withholding Estimator.

Inflation 2022 Back Motor Fuel Back. If you attempt to use the link below and are unsuccessful please try again at a later time. 2021 Tax Year Return Calculator in 2022.

The amount you earn. Know how much to withhold from your paycheck to get a bigger refund. The information you give your employer on Form W4.

Submit or give Form W-4 to your employer. For Tax Year 2022 you would use the 2022 Tax Return Estimator to optimize your W-4. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer.

Manage your tax return goals via your W-4 Forms now. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment.

The Liberty Withholding Calculator is a tax estimator tool only and should only be used to calculate an individuals estimated tax withholdings. Keep in mind that you can also use the 1040-ES to pay estimated taxes throughout the year if you have additional. This product feature.

This can be found on your prior year tax return as follows. The tool will create a 2022 W-4 or Tax Withholding Forms for you and your spouse if applicable that is based on these your 2021 Tax Return results. You dont need to do anything at this time.

Ask your employer if they use an automated system to submit Form W-4. Estimate your 2022 refund taxes you file in 2023 with our tax calculator by answering simple questions. Calculate IRS and State Income Tax Withholding.

Withholding Tax Tobacco Tax. The amount of income tax your employer withholds from your regular pay depends on two things. Withholding tax is income tax withheld from employees wages and paid directly to the government by the employer and the amount withheld is a credit against the income taxes the employee must pay.

To change your tax withholding amount. To keep your same tax withholding amount. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

Irs Finalizes 2022 Federal Tax Withholding Guidance And Forms Ice Miller Llp Insights

How To Calculate Federal Income Tax

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Tax Withheld Calculator Shop 57 Off Www Wtashows Com

Orange Icon In 2022 Orange Icons Gaming Logos Orange

Gxoof 3vg0zqzm

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Tax Withheld Calculator Shop 56 Off Www Wtashows Com

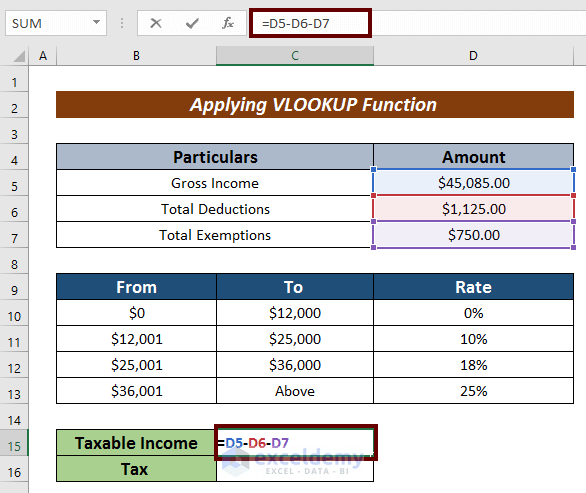

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

How To Calculate Federal Income Tax

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

Did You Fill Out Your W 4 Federal Tax Withholding Form Correctly The Mint Hill Times

2022 Income Tax Withholding Tables Changes Examples

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

Calculating Federal Income Tax Withholding Youtube

Estimated Income Tax Payments For 2022 And 2023 Pay Online